Community Economic Development Month

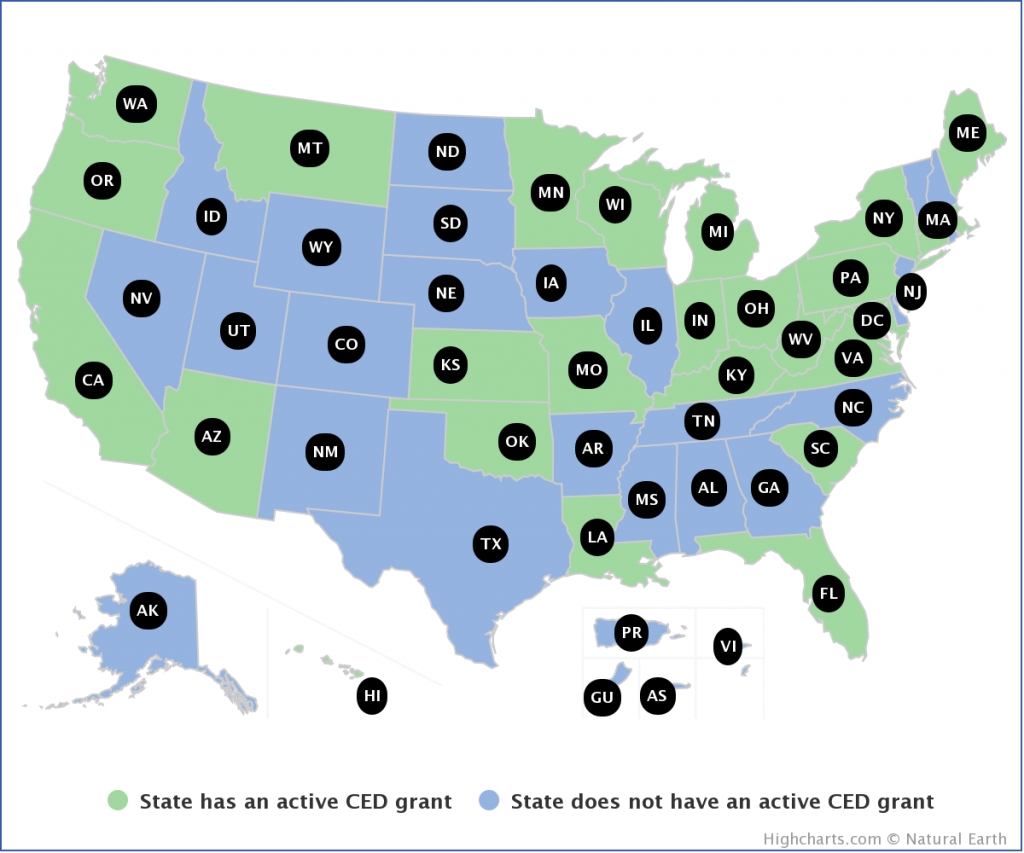

The Office of Community Services (OCS) is celebrating Community Economic Development Month in October 2021. Throughout the month, OCS plans to share how they are supporting community economic development efforts throughout the county. We’ll also be highlighting CED grantees on our website. First up is a case study from Coastal Enterprises. Coastal Enterprises ($800,000 in …